Retirement is a significant life milestone, a time of well-deserved rest, relaxation, and a second chance to fulfill lifelong dreams. However, it's also a period of heightened vulnerability, particularly regarding financial security. To ensure a comfortable and worry-free retirement, it's crucial to adopt a proactive approach to risk management, much like managing risks in other aspects of life.

Retirement risk management involves identifying, assessing, prioritizing, and mitigating potential financial threats that could jeopardize your retirement lifestyle and goals. It's about building a robust financial safety net that can withstand unexpected events and market fluctuations. The core principles mirror general risk management:

Risk Identification: Pinpointing the specific risks you face in retirement. These can be internal (health, longevity) or external (taxes, market performance, inflation).

Risk Assessment: Evaluating the potential impact and likelihood of each identified risk based on your current situation and various stress-tested scenarios.

Risk Prioritization: Ranking each risk based on how much it impacts your peace of mind. This helps you identify those risks which need immediate attention and those where you can take a “wait and see approach”.

Risk Mitigation: Developing strategies to reduce or eliminate the negative consequences of the highest priority risks. This could involve tax planning, investment reallocation or diversification, or insurance.

Risk Monitoring: Regularly reviewing and updating your risk management plan to account for changes in your circumstances, market conditions, and personal priorities.LifeSpend Planner helps answer the question most traditional plans never fully address:

.

Our Approach

Current LifeSpend Plan

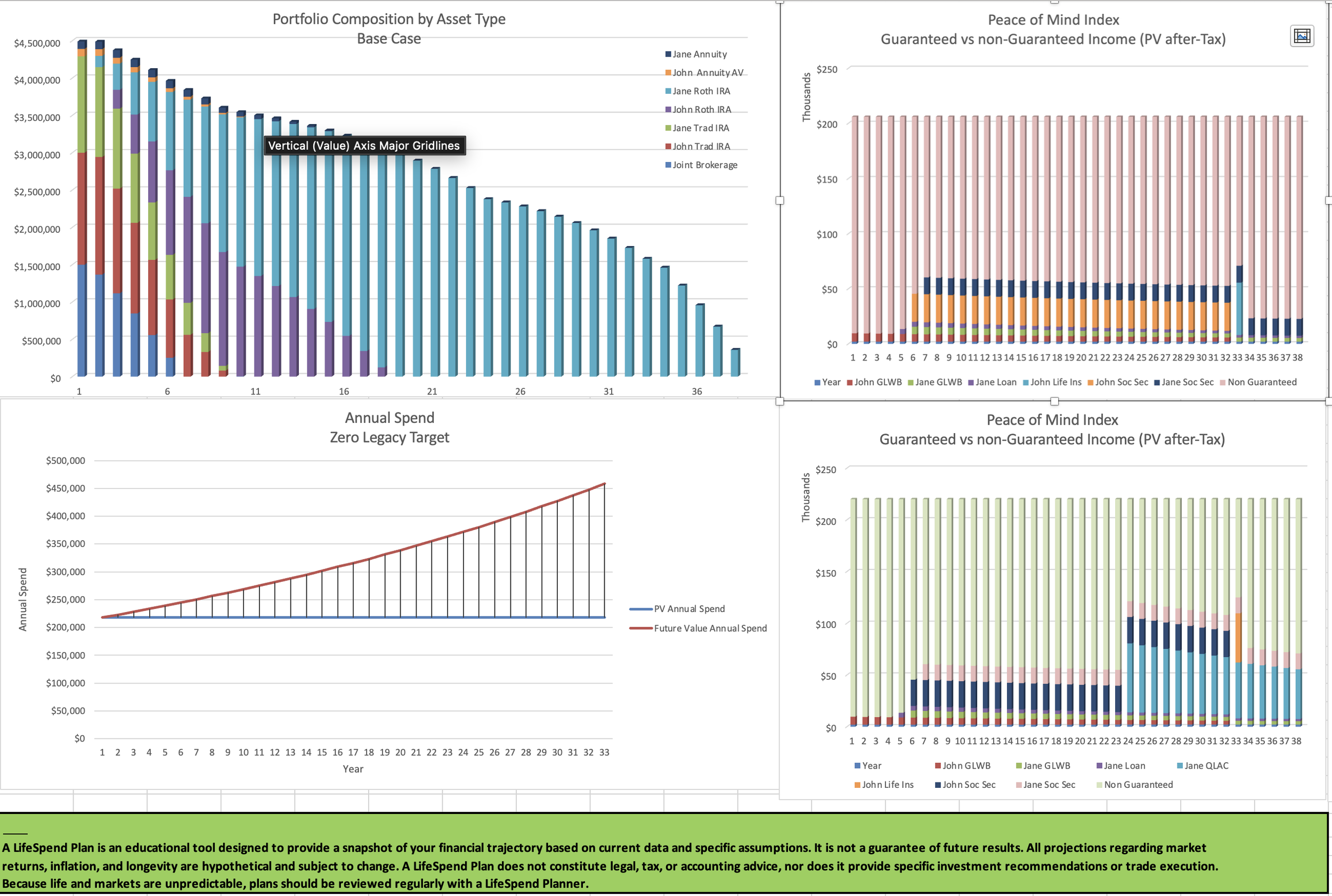

We personalize your financial journey with a holistic view of your current LifeSpend plan. Only by looking at all assets and sources of future income can you best understand how much you can spend based on your desired legacy, lifestyle goals, and risk tolerance. Initial Setup as low as $2500 - which includes one free follow-up session.

Analyze and Implement Strategies for LifeSpend Plan

We analyze your current LifeSpend Plan and offer alternative strategies to increase the potential amount of money you will be able to spend each month or leave as a legacy to your loved ones. As the ability to earn income from new sources is more limited in retirement, we focus on your current asset allocation and make sure you have enough guaranteed income to give you Peace of Mind..

LifeSpend Plan Follow up

Your needs may change over time or you may want to make a large one-time expenditure such as a new car or travel adventure. Also, external forces such as new family responsibilities, emergencies, or shifts in the economy could impact your planning. We are here every step of the way with updates to maintain your peace of mind regarding your LifeSpend plan. You can setup your reviews as frequently as you would like.

Contact Us

Just fill out and submit the brief form to ask a question or to receive updates on new articles as published